I. Current Market Share Overview

Dominant Position

Chinese switchgear accounts for approximately 60%-70% of Indonesia’s import market (2023 industry estimates), solidifying its position as the top supplier. This significantly exceeds competitors from Japan (15%-20%), South Korea (<10%), and European manufacturers (Siemens, ABB, which dominate the high-end segment).

Key Segments: Chinese manufacturers lead in medium and low-voltage switchgear (<40.5kV) due to cost competitiveness. High-voltage products (72.5kV+) remain dominated by Japanese/European firms, though China’s share is rising.

Key Drivers

Cost Advantage: Chinese products are 30%-50% cheaper than Japanese/European equivalents, aligning with Indonesia’s infrastructure cost-efficiency demands.

Infrastructure Demand: Indonesia’s annual electricity consumption grows at 6%-7%. Government initiatives like the 35,000 MW Power Plant Program (2021–2030) and smart grid upgrades drive substantial demand for distribution equipment.

Geographic & Trade Advantages: RCEP tariff reductions (0% duty on select switchgear categories) and shorter shipping routes (~7 days from South China to Java) enhance supply chain efficiency.

II.Competitive Landscape & Challenges

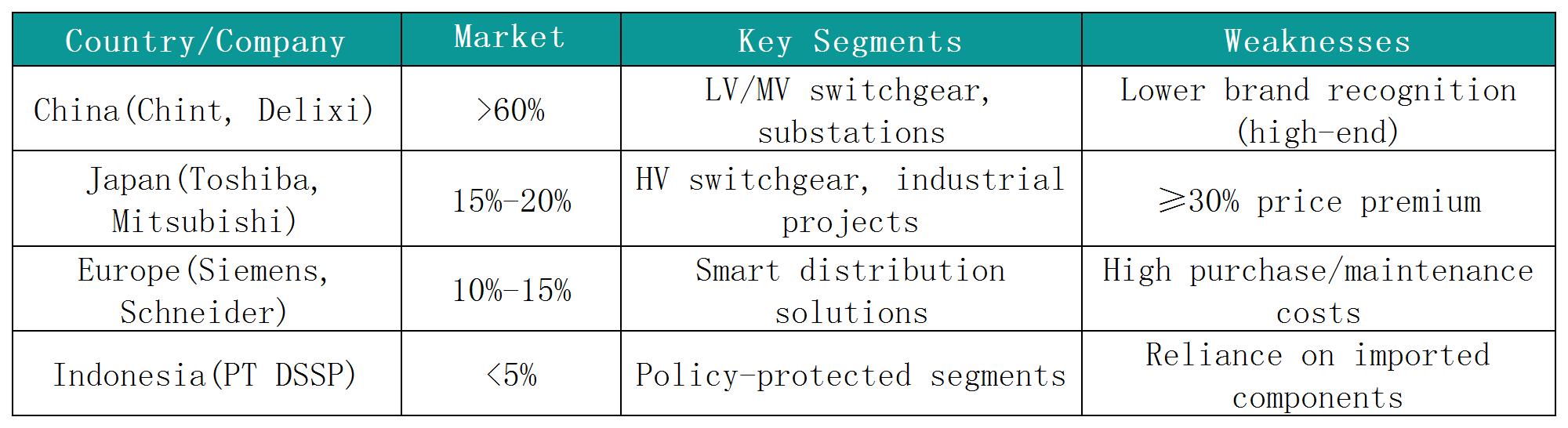

Major Competitors

Critical Challenges

Localization Policies: Indonesia’s 40% Domestic Content Requirement (TKDN Regulation) compels Chinese firms to establish local JVs (e.g., Chint’s PT CET).

Technical Standards: Mandatory SNI Certification (equivalent to IEC standards) causes delays, resulting in lost orders for some Chinese suppliers.

Intensified Competition: Japan leverages ODA loans for power projects (e.g., Java-Bali transmission line), mandating Japanese equipment.

III. Future Trends & Opportunities

Growth Sectors

Renewable Energy Integration: Indonesia’s 20.9 GW solar/wind target (2021–2030) requires smart switchgear for distributed grids.

Smart Grid Deployment: Aging grid replacements in Jakarta drive 12% YoY growth for digital ring main units (RMUs) (Frost & Sullivan).

Strategies for Chinese Firms

Technology Upgrades: Leaders (e.g., Xiamen Huadian) now offer intelligent switchgear compliant with IEC 62271, narrowing the gap with EU/Japanese rivals.

Localized Production: Factories in Batam/Karawang leverage ASEAN-China FTA tariff benefits.

Integrated Services: “Equipment + Maintenance” bundles (e.g., Shandong Electrical Engineering) address Indonesia’s skilled labor shortage.

Conclusion: Steady Expansion with Structural Upgrades

Short Term: China maintains >65% share in LV/MV markets; high-voltage share rising to 30% (from 25% in 2022).

Long Term: Share may reach 70%-75% through technical branding and RCEP implementation, contingent on mitigating trade risks (anti-dumping probes) and geopolitical volatility (e.g., nickel export policies affecting industrial power demand).